455 Avenue Road, Suite 100, Toronto, Ontario, M4V 2J2

Tel: (416) 966-9675 Fax: (416) 966-9677

CALU is pleased to provide the English translation of the APFF Financial Products Round Table, as originally presented at the APFF meeting held in October 2004. In addition to the APFF, CALU would like to thank CALU Member Mme Jocelyne Gagnon, who participated in the Round Table presentation, and who recommended this information to CALU as of interest to the advanced life underwriting community in Canada.

Table of Contents

APFF Association de planification fiscale et financière

CONVENTION Montreal October 6, 7 and 8, 2004

QUESTIONS AND ANSWERS

October 8, 2004 2:00 p.m. - 2:45 p.m.

Financial Products Round Table

445 Saint-Laurent Boulevard, Suite 300, Montreal, QC, Canada H2Y 2Y7 - E-mail address: apff@apff.org Tel: (514) 866-2733 or 1-877-866-2733 - Fax: (514) 866-0113 or 1-877-866-0113

Copyright 2004 APFFPrinting of these texts is sponsored by RBC Investments Financial Planning

JOCELYNE GAGNON

Ms. Gagnon has been working for PPI Québec inc. as Director, Taxation since 1989. Her main role is to provide technical assistance to agents associated with PPI Québec inc., with respect both to tax and estate planning and to identification of their affluent clients' insurance needs.

A graduate of the École des hautes études commerciales' administration program, Ms. Gagnon also holds a Master of Taxation degree from the Université de Sherbrooke. In addition, she holds the titles of Chartered Life Underwriter, Chartered Administrator and Financial Planner.

She was president of the IQPF for the 92-93 term and was made an honorary member in 1994. She is also a member of the APFF, CTF, CALU and Advocis.

PAULE GAUTHIER

Ms. Gauthier is Director, Taxation with National Bank Financial. She specializes in estate and tax planning in the investments and insurance field.

Ms. Gauthier earned her Chartered Accountant designation in 1986 and holds a Master of Laws, Taxation option, from the Université de Montréal and the École des hautes études commerciales. She completed additional studies in mathematics and statistics at the Université de Montréal and in taxation at the Canadian Institute of Chartered Accountants.

Ms. Gauthier previously spent nine years as a tax and estate planning consultant with two national and international life insurance companies and seven years in financial statement preparation and auditing, personal and corporate tax planning, for both a national chartered accountancy corporation and a small firm of chartered accountants.

Ms. Gauthier has been a speaker several times for the Association de planification fiscale et financière, at annual conventions and technical seminars.

GHISLAIN MARTINEAU

Mr. Martineau has been working for the Canada Revenue Agency (CRA) since 1977. Since 1984, he has worked in various sections of the Income Tax Rulings Directorate and now manages the Financing and Plans Section of this Directorate in Ottawa. Mr. Martineau's role includes handling such financing issues as deductibility of interest, tax on large corporations, deferred income plans, and non-profit and charitable organizations.

Mr. Martineau has given presentations at seminars and conventions organized by the Association de planification fiscale et financière and the CRA.

LAWRENCE PURDY

Mr. Purdy is a member of the Ontario Bar Association and since 1998 has been chief of the Tax Legislation Division with the Department of Finance (Canada). A graduate of Bishop's University (BA 1981) and Queens University (LL.B. 1988), Mr. Purdy has also completed the In-depth Tax Course from the Canadian Institute of Chartered Accountants.

The main focus of the group lead by Mr. Purdy is corporate and international taxation. Mr. Purdy is also a Canadian delegate to the OECD Forum on Harmful Tax Practices. His leisure activities include canoeing and camping in the Canadian wilderness.

Copyright 2004 APFF

Printing of these texts is sponsored byRBC InvestmentsFinancial Planning

A corporation borrows an amount of money from a financial institution to acquire an interest in a life annuity contract on the life of its shareholder. As a condition of the loan, the lender requires that the corporation purchase a term life insurance policy on the life of its shareholder and that the interest in this policy be assigned to the lender as collateral for the loan. The annuity contract is subject to subsection 12.2(1) ITA. The financial institution and the insurer are separate entities.

Can the corporation deduct the insurance premiums under the terms of paragraph 20(1)(e.2) ITA. More specifically, is the condition set out in subparagraph 20(1)(e.2)(i)(B) ITA satisfied?

CRA's Response

The premiums for a life insurance policy used as collateral for a loan may be deductible under the terms of paragraph 20(1)(e.2) ITA if, in particular and as set out in subparagraph 20(1)(e.2)(i)(B) ITA, the interest payable on the loan is deductible in computing the income of the borrower for the year or would be without subsections 18(2) and (3.1) and sections 21 and 28 ITA.

Subparagraph 20(1)(c)(iv) ITA allows a deduction of interest on money that is borrowed and used to acquire an interest in an annuity policy in respect of which subsection 12.2(1) ITA applies or would apply if the contract had an anniversary day in the year at a time when the taxpayer held the interest. However, where annuity payments have begun under the contract in a preceding taxation year, the amount of interest paid or payable in the year shall not be deducted to the extent that it exceeds the amount included under section 12.2 ITA in computing the taxpayer's income for the year in respect of the taxpayer's interest in the contract.

As a result, a portion of the interest on the money borrowed and used to acquire an interest in an annuity contract may not be deductible in computing a taxpayer's income. However, it is our opinion that the condition set out in subparagraph 20(1)(e.2)(i)(B) ITA is satisfied for a taxation year if all or part of the interest is deductible in that year under the terms of subparagraph 20(1)(c)(iv) ITA. If no interest is deductible in a taxation year, this condition is not satisfied for that taxation year.

Copyright 2004 APFF

Printing of these texts is sponsored by RBC InvestmentsFinancial Planning

In order to qualify for the election under section 86.1 ITA, the foreign corporation initiating the spin-off must provide several pieces of information to the CRA for consideration and determination of the spin-off's qualification for the election under this section.

Where the shareholder wishes to elect not to be taxed on the dividend received and to allocate the ACB of the original shares to the new ones, he must provide information on the fair market value of the securities prior to the spin-off and immediately afterward. These values will be used as the basis for allocation of costs between the shares.

In practice, Canadian shareholders do not always have the information that must be provided to the CRA to make the election. This occurs in the following situations:

The information provided to American shareholders enables them to use a percentage of cost allocation between the shares instead of a pro rata calculation based on the market value. It appears that calculation of the percentage used by American shareholders and based on section 355 of the Internal Revenue Code is essentially the same as the allocation obtained using the market values of securities immediately after the spin-off.

Furthermore, foreign reorganizations affect taxation of many Canadian investors. The impact of the relevant sections of the ITA (most often 86.1, 87(8), 85.1(4)) must be analyzed most of the time by a tax specialist, through examination of disclosure documents on the reorganization made available to all shareholders by the corporation. Many hours will need to be devoted to this analysis and key information may have to be obtained from other documents in order to reach a conclusion. Most investors will not have the resources needed to analyze, or have analyzed, the tax implications affecting them. Do you plan to help Canadian shareholders in a more efficient and consistent manner in their assessment of the Canadian tax implications of significant multinational reorganizations, for which a considerable proportion of Canadian investors may hold securities?

CRA's Response

A great deal of information regarding the application of section 86.1 of the ITA is accessible to everyone on the CRA web site at the following address: www.cra-arc.gc.ca/tax/business/topics/foreign-e.html. Some of the information you will find at this address includes a description of the rules set out in section 86.1 of the ITA and repercussions stemming from their application, as well as the conditions that must be satisfied and the procedure for making an election under this provision. More information regarding section 86.1 of the ITA is also available through various documents published by the CRA, such as Technical News (one of which is No. 28 dated April 24, 2003) or the technical interpretations. As well, it is also possible for a taxpayer to contact the CRA Tax Rulings Directorate to obtain an advance ruling or a technical interpretation with respect to this provision. Lastly, the CRA also offers a telephone information line.

Copyright 2004 APFF

Printing of these texts is sponsored byRBC InvestmentsFinancial Planning

For Finance:

The information provided to American shareholders enables them to use a percentage of cost allocation between the shares instead of a pro rata calculation based on the market value. It appears that calculation of the percentage used by American shareholders and based on section 355 of the IRC is essentially the same as the allocation obtained using the market values of securities immediately after the spin-off.

For spin-off type reorganizations set out in section 86.1 ITA, can you consider introduction of a legislative change in order that Canadian shareholders may base their calculation for allocation of the ACB of shares on the percentages established under section 355 of the IRC and usually available to American shareholders on the corporation web site?

Department of Finance's Response

We understand that section 355 of the United States IRC regarding distribution of shares requires that shareholders allocate the cost base between the original and new shares based on their relative fair market value.

Section 86.1 of the Income Tax Act requires a similar allocation. If the American percentage in question is simply the mathematical expression of relative fair market values, the allocation of the cost base should then be the same. However, if the percentage represents only an approximation of the fair market value, it's not certain that this measure will be appropriate for allocating the cost base.

At the very least, we will have to obtain more detailed information on the nature of the approximation, the foundation for its computation and the extent to which it might differ from the fair market value.

For example, the question refers to a distribution of shares which is part of a broader transaction. Insofar as the percentage indicated with respect to section 355 reflects the American tax consequences of this transaction - consequences that might differ under the Canadian tax system - this percentage might not be appropriate with respect to section 86.1. If the question concerns more specifically the difficulties Canadian shareholders must face when the corporation distributing the shares refuses to provide certain pieces of information to the Department (including the type and fair market value of property transferred to residents of Canada) as is required in paragraph 86.1(2)(e), and if its intent is to determine whether the information found on a given corporation's web site is deemed to satisfy these requirements, the question must be approached differently.

Where the given corporation is a foreign corporation over which Canada has no audit authority and could not otherwise collect the relevant information, the Act clearly states that it is the responsibility of the corporation itself to provide the information to the Department. This is a reasonable requirement, given that the Canadian taxpayer benefits from a deferment of tax in respect of the transaction.

Copyright 2004 APFF

Printing of these texts is sponsored byRBC InvestmentsFinancial Planning

M.A. and M.B. carry on a business through a corporation of which they each own 50% of the shares.

They also run a professional practice through a partnership in which they each hold a 50% share.

The corporation purchased life insurance policies on the lives of M.A. and M.B. in accordance with the terms of the shareholder agreement. The corporation is using the option of making additional deposits to each life insurance policy. The corporation then obtains a commercial loan from a financial institution secured by the life insurance policies. The corporation wishes to use the money from the loan to lend in turn to the partnership. The corporation will charge the partnership a rate of interest on the loan that is slightly higher than the rate the corporation must pay on its own loan to the financial institution.

The partnership will use the money from the loan for its operations instead of using an existing line of credit.

Could subsection 15(2) ITA apply to the loan received by the partnership from the corporation? Would the position be the same if the interest rate charged to the partnership by the corporation were identical to the one the corporation is paying to the financial institution?

Could subsection 15(1) ITA apply to the loan received by the partnership from the corporation?

CRA's Response

In the scenario you have described, we feel that subsection 15(2) ITA could apply to the partnership to include the amount of the loan in computation of its income, unless the loan falls under one of the exceptions set out in subsections 15(2.3) to (2.6) ITA. More specifically, subsection 15(2.3) regarding loans granted by a corporation in the ordinary course of its business of lending money or subsection 15(2.6) ITA regarding the loan repayment period could be relevant to this scenario. However, these exceptions do not seem to apply to this scenario, based on the information you have submitted. Although the partnership is not itself a shareholder of the corporation, subsection 15(2) ITA also applies to loans received by a person or partnership connected with a shareholder of the corporation. Subsection 15(2.1) ITA gives a definition of a person connected with a shareholder of a particular corporation, one of which is a person who does not deal at arm's length with the shareholder. We have indicated several times that the term 'person connected with a shareholder of a particular corporation' as set out in subsection 15(2.1) ITA may include a partnership. As to whether a partnership is not dealing at arm's length with a shareholder of the particular corporation is a question of fact. Interpretation Bulletin IT-419R Meaning of Arm's Length, August 24, 1994, sets out the criteria used to determine whether or not people have an arm's length relationship. In your example, the partnership and the corporation belong to the same two individuals so we tend to believe that these individuals are acting in concert and controlling the partnership together, such that they are not dealing with the partnership at arm's length.

The interest rate charged by the corporation to the partnership on the loan does not change our opinion about application of subsection 15(2) of the Act.

In a scenario where the loan received by the partnership falls under one of the exceptions set out in subsections 15(2.3) to (2.6) ITA, the amount of the loan would not be included in computation of the partnership's income under the terms of subsection 15(2) ITA. However, subsections 80.4(2), 15(9) and 15(1) ITA could apply to include a benefit in computation of the partnership's income unless the interest rate paid by the partnership on the loan is higher than or equal to the regulated rate.

Lastly, where the amount granted by the corporation to the partnership is a loan or indebtedness as in the scenario presented, subsection 15(1) ITA does not apply to that amount as the partnership has a legal obligation to repay it. However, in a scenario where that amount would be rather an allocation of funds by the corporation, subsections 56(2) and 15(1) ITA could apply to include that amount in computing income of shareholders of the corporation.

Copyright 2004 APFF

>Printing of these texts is sponsored byRBC InvestmentsFinancial Planning

Paragraph (d) of the definition of 'capital dividend account' in subsection 89(1) ITA provides that the excess of the life insurance proceeds received by a private corporation after May 23, 1985 as a consequence of the death of a person over the 'adjusted cost basis' (hereafter ACB) of the policy, within the meaning assigned by subsection 148(9) ITA, immediately before that person's death, is added to the 'capital dividend account' (hereafter CDA) of the company.

For example, a corporation that is the policyholder and the beneficiary of a life insurance policy receives $850,000, after deduction of the $150,000 policy loan ($1,000,000 - $150,000), in accordance with the life insurance contract.

Death benefit $1,000,000

ACB without any policy loan $200,000

Policy loan $150,000

The ACB immediately after the death equals $50,000 ($200,000 - $150,000)

We believe the amount added to the CDA will be $950,000 ($1,000,000 - $50,000)

Can the CRA confirm our interpretation?

CRA response

We confirm that for the purpose of the calculation of the CDA, the life insurance policy ACB is $50,000. The fact that the life insurance proceeds are reduced by the amount of the policy loan at the time of the death is not a repayment of the policy loan as provided by Element 'E' of the definition of ACB in subsection 148(9). Actually, the ACB of the policy for purposes of the CDA definition is calculated immediately before death. On the other hand, Element 'E' of the definition of 'ACB' requires a consideration of the policy loan repayment that occurs before the ACB calculation.

Generally speaking, when the life insurance contract provides that as a consequence of the death of the life insured, the beneficiary is entitled to receive the death proceeds less the amount of the policy loan outstanding at death, we consider the remaining net amount to be the life insurance proceeds applicable for the purposes of the calculation of the policy ACB.

Consequently, in the example illustrated above, the amount to be credited to the CDA will be $800,000, being the life insurance proceeds ($850,000) received by the company as a consequence of the life insured's death minus the ACB of the policy to the company ($50,000) immediately before the death.

Copyright 2004 APFF

Printing of these texts is sponsored byRBC InvestmentsFinancial Planning

A personal trust may occasionally make certain investments, including in prescribed debt obligations as defined in Regulation 7000. This regulation sets out computation of an amount, on the obligations referred to in Regulation 7000 such as stripped coupons, which will be included in income according to subsections 12(4) and (9) ITA.

The trust generally does not cash the income generated by the stripped coupon until the coupon matures but nevertheless must be taxed on the income accrued annually without having cashed the funds and as a result without having distributed them to beneficiaries. As well, at disposition of the obligation, where there is an increase in the market interest rates between the purchase and sale dates of the obligation, the trust will realize a capital loss that it will not be able to distribute to beneficiaries of the trust.

Can a trust allocate annually to beneficiaries a 'phantom income' from the annual taxation of accrued income on a prescribed debt obligation such as a stripped coupon and if so, what terms must the trust set out to allow this allocation?

CRA's Response

Paragraph 104(6)(b) ITA indicates that there may be deducted in computing the income of a trust for a taxation year such amount as the trust claims not exceeding the amount representing the income of the trust as became payable in the year to a beneficiary. Amount payable is defined in subsection 104(24) ITA which specifies that an amount shall be deemed not to have become payable to a beneficiary in a taxation year unless it was paid in the year to the beneficiary or the beneficiary was entitled in the year to enforce payment of the amount. Deemed interest income according to subsection 12(9) ITA from debt obligations referred to in Regulation 7000 is not trust income as defined in the Civil Code. As a result, this income is not liable to constitute an income payable to a beneficiary in the year under terms of a trust agreement. However, as indicated at the STEP (Society of Trust and Estate Practitioners) conference earlier this year, we allow a deduction under the terms of subsection 104(6) ITA in respect of deemed income if the terms of the trust agreement are such that the trustee must pay an amount equivalent to this income to the beneficiary or if the trustee may, under terms of the trust agreement, pay or make payable an amount equivalent to the amount deemed to be income under terms of the ITA, if it exercises this discretionary authority irrevocably and without conditions prior to the end of the trust's taxation year.

For Finance

Personal trusts and mutual fund trusts cannot allocate losses to their unit holders, unlike segregated funds which may allocate their losses to the policyholder. Does the Department plan to allow personal trusts and mutual fund trusts to allocate their losses to unit holders?

Department of Finance's Response

As you know, the losses realized by a trust may be used only by that trust. No provision of the Act authorizes transfer of those losses to beneficiaries.

It follows that if the capital gains and revenues of the trust are not sufficiently high, the portion of losses not offsetting those capital gains and revenues cannot be used. The impact of this situation may be particularly significant where the period set out for use of non-capital losses is expiring or where the trust may be required to proceed with distribution of the total amount of its current income.

Prior to 1988, the Act did not include any mechanism that could help the trust retain its income where it was required, under terms of its trust agreement, to distribute its current income. One can assume that a trust not subject to such an obligation may retain a portion of income sufficient to use the losses of other years by offsetting them against this income.

Since 1988, a trust may make an election in order that any amount of income payable to beneficiaries be deemed trust income for which a deduction may be taken into account in computing the taxable income of the trust. In this way, the trust may distribute its income while retaining, for income tax treatment, an amount of income sufficient to take advantage of its non-capital losses and its eligible capital losses.

As well, the option for the trust to make an election not to be subject to the rollover rule set out in subsection 107(2) where the property of the trust is distributed to a beneficiary may enable the trust to realize its accumulated gains such that it may apply its losses to offsetting these gains.

We can therefore see that the Act contains various mechanisms enabling a trust to take advantage of tax benefits associated with the rules on loss carry forward or carry back.

The fact that these mechanisms consist of income retention rules rather than loss distribution rules may be viewed as the result of a conscious decision. Note in particular that a loss distribution mechanism would raise certain concerns about the risk of such schemes as selective distribution of losses among beneficiaries. This is a very real risk given the leeway trust contracts allow. The anti-avoidance provisions that would be required to eliminate this risk would make the rules more complex and increase the compliance cost, without in any way guaranteeing the effectiveness of these rules. (For example, what treatment would be applicable to the at-risk amount in the case of a trust?).

In conclusion, it must be considered that the current rules affecting treatment of trust losses ensure a fair balance among various conflicting strategic objectives.

For this reason, we are not contemplating recommendation of any relaxation whatsoever of these rules.

Copyright 2004 APFF

Printing of these texts is sponsored byRBC InvestmentsFinancial Planning

Context

Ms. X is divorced from Mr. Z and is receiving spousal support of $50,000 per year. Mr. Z dies and his children (who are not Ms. X's children) must continue to pay Ms. X the same amount for her lifetime.

The best way for the children to fulfill their obligation and provide the required security for Ms. X is to purchase a life annuity that will guarantee Ms. X the necessary income.

The children's liquid assets are within a corporation ('CHILDCO') so if the children use these liquid assets to purchase a life annuity for Ms. X, subsection 15(1) will apply.

The following plan is therefore proposed:

Ms. X will create a corporation ('NEWCO') and will hold all common shares issued and in circulation of its capital stock. CHILDCO will purchase non-voting, non-participating preferred shares in an amount of $1,000,000.

NEWCO will use this $1,000,000 to purchase a non-prescribed life annuity combined with a life insurance policy on Ms. X's life. NEWCO will receive the annuity and pay the taxes on its taxable portion. NEWCO will also pay the cost of insurance and pay Ms. X a taxable dividend.

An agreement will be signed to the effect that at Ms. X's death, the proceeds of the insurance on Ms. X's life will be used for buyback by NEWCO of the preferred shares of its capital stock held by CHILDCO.

Question

Does the CRA agree with our interpretation, to the effect that subsection 15(1) ITA would not be applicable to the proposed plan?

CRA's Response

It must first be emphasized that the context of this question gives only a basic description of a given scenario (the 'Given Scenario'). As a result, we will be making only general comments on the potential application of subsection 15(1) in respect of the children in the Given Scenario.

The planned transactions described in the context of this question enable the obligations. incumbent upon the children to be fulfilled. In this way, a benefit results from these planned transactions for the children.

Therefore, subsection 15(1) ITA could apply to the Given Scenario, requiring the children to include in computing their income the value of a benefit that CHILDCO would have conferred on them, if CHILDCO were to become less valuable due to the transactions.

Given that the context of this question gives only a basic description of the Given Scenario, it is difficult to definitively establish the value of the benefit that would be governed by subsection 15(1). The value of this benefit could, however, correspond to the amount the children would have to pay, under similar circumstances, in order to obtain from a person at arm's length from them the same benefit as arising from the Given Scenario.

Copyright 2004 APFF

Printing of these texts is sponsored byRBC InvestmentsFinancial Planning

For Finance:

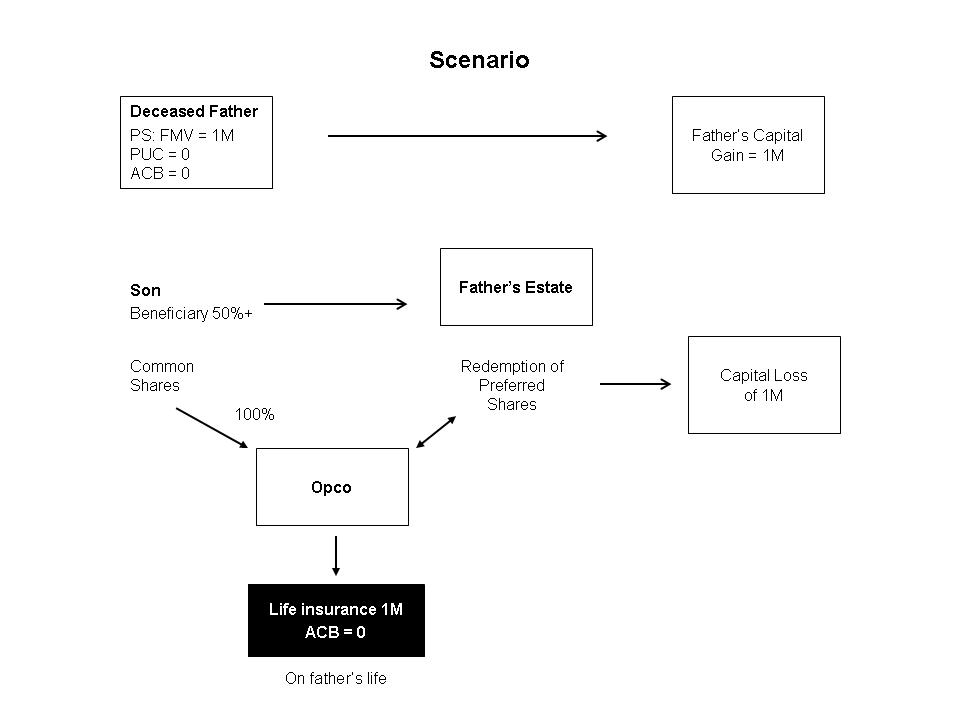

New definition of 'affiliated persons' (March 23, 2004 budget) and its impact on share redemption at death within the context of planning and transfer of a family business at death.

Another method traditionally used to eliminate double taxation at death of a shareholder in a private corporation involves ensuring that the corporation redeems shares (often freeze shares) held by the estate, in the estate's first taxation year, thereby creating a capital loss. This loss may normally be offset against the capital gain at death of the deceased shareholder.

The change in the definition of affiliated persons specifying that a trust is affiliated with each of its beneficiaries having a majority interest in the trust income or capital of the trust (estate) will often result in making the estate and the corporation of which it holds shares affiliated with each other and in bringing about non-utilization of the capital loss by application of the rule set out in subsection 40(3.6) of the ITA.

At his death, the father realizes a taxable capital gain of $1,000,000.

Opco redeems the preferred shares held by the estate, using the capital dividend account created by receipt of the life insurance proceeds.

The estate realizes a capital loss of $500,000 or $1,000,000 if subsection 112(3.2) ITA is not applicable (grandfathered shares).

Prior to the March 23, 2004 budget

Subsection 40(3.6) is not applicable and does not deny the capital loss since the estate and Opco are not affiliated persons immediately after the redemption of preferred shares.

Under the terms of subsection 164(6), the estate's loss will be offset against the deceased's capital gain.

After the March 23, 2004 budget

A beneficiary entitled to a majority interest in the income or capital of the trust will be affiliated with the estate.

Any person affiliated with a beneficiary entitled to a majority interest in the income or capital of the trust will be affiliated with the estate.

The son is affiliated with Opco as he holds all the voting shares.

Given that the son is entitled to a majority interest of the estate, Opco is affiliated with the estate.

In this scenario, subsection 40(3.6) ITA would apply such that the estate's capital loss is denied following redemption of preferred shares.

Question:

Do you plan to make a change allowing the deceased to use the loss realized on share redemption by the estate, by excluding estates from application of this rule or by another means?

Department of Finance's Response

It appears logical and appropriate to us that a trust be considered affiliated with its majority beneficiary as well as with a corporation controlled by that beneficiary.For example, if a trust sold property to that corporation, realization of a loss by the corporation would not be in keeping with the tax policy. We do not plan to recommend changes to the rules for affiliated persons in their current and proposed version as we feel they correctly set out the circumstances under which a trust and another person must be considered affiliated.

However, there is a special element in the described case: the estate, in the context of subsection one hundred and sixty-four six (164(6)), is treated somewhat as if it were equivalent to the deceased father and a father is not affiliated with a corporation controlled by his son.

Given this feature of 164(6), the Department is currently studying whether changes might be warranted so a loss could be declared under terms of the subsection in scenarios of estate freeze and post-mortem tax planning.

Copyright 2004 APFF

Printing of these texts is sponsored byRBC InvestmentsFinancial Planning

For Finance

Recently, the United States negotiated nil rate of withholding tax for dividends under tax treaties or agreements with the United Kingdom, Australia and Mexico. Further similar provisions are planned for certain countries' treaties.

Does the Department of Finance intend over the long term to reduce or eliminate withholding tax for non-residents on interest and dividends for affiliated and non-affiliated parties?

Department of Finance's Response

In the past, the United States and Canada adopted different positions respecting taxation of interest and dividends paid to non-residents. The American policy is this regard has for some time now been to reduce, or even eliminate where possible, taxation of these amounts by the country of origin while we have generally retained our right to tax payments originating from Canada.

However, the Government of Canada has in the past taken some measures to reduce non-resident tax payable on Canadian earned income. One of Canada's policies is to establish, under the tax treaties, the maximum tax rate by the country of origin. One of the important points to mention in this regard is negotiation of treaties limiting the tax rate to 5% on direct dividends (i.e. paid by an affiliate to its parent corporation).

The Department of Finance is aware of the economic argument advanced to justify elimination of withholding tax on interest and dividends. Moreover, in fiscal negotiations with the United States, we are discussing the possibility of further reducing the taxes applicable in this regard, the emphasis being on interest paid to persons at arm's length. That being said, Canada's current general policy in this respect is not the same as that of the United States and we do not intend to alter this situation in the near future.

Copyright 2004 APFF

Printing of these texts is sponsored byRBC InvestmentsFinancial Planning

More and more, businesses are offering to certain categories of executive employees (non-shareholders) individual critical illness insurance policies and individual long-term care insurance policies (without the return of premium at maturity rider) under which the employees are beneficiaries. These insurance policies are not considered life insurance. They are used to top up the regular group insurance coverages available to all employees, such as life, long-term disability, drug and dental insurance.

Are employer-paid premiums for the critical illness and long-term care coverages offered to this category of executive employees deductible by the employer?

Does the fact that the employer pays such premiums on behalf of its employees constitute a taxable benefit for the employees pursuant to paragraph 6(1)(a) of the ITA?

Is the lump-sum payment received by employees under a critical illness insurance policy subject to taxation pursuant to paragraph 6(1)(f) of the ITA?

Are the payments received by employees on a periodic basis under a long-term care insurance policy subject to taxation pursuant to paragraph 6(1)(f) of the ITA?

CRA's Response

Critical Illness Insurance Policy

Employer-paid premiums would be deductible if they were incurred by the employer for the purpose of gaining or producing income from a business or a property and if they were not an outlay of capital. Where an employer pays insurance premiums for some of its employees, and the employees are the beneficiaries of the insurance, we are of the opinion that the employer is incurring expenses for the purpose of gaining or producing income from its business. As a result, employer-paid premiums for individual critical illness insurance policies covering certain employee categories could be deductible from the employer's income.

Where an employer pays insurance premiums on behalf of its employees, a taxable benefit may arise for the employees under the terms of paragraph 6(1)(a) of the ITA, unless one of the exceptions set out in that paragraph applies. Subparagraph 6(1)(a)(i) of the ITA provides for an exception in the case of benefits derived from contributions to a group sickness or accident insurance plan. Critical illness insurance is generally considered sickness or accident insurance. Even if the critical illness insurance is an individual insurance policy does not automatically mean that such insurance policy is not part of a group plan. In our opinion, a group insurance plan is a plan under which a certain number of employees are covered, either under a single policy between the insurer and an employer or under individual policies that are written as part of a plan set up by the employer for the insured employees. Whether the individual insurance policies are written as a group sickness or accident insurance plan is a question of fact that we would be unable to rule on without examining a particular situation. Assuming that the individual critical illness insurance policies are part of a group plan, there would be no taxable benefit for management employees by reason of the exception set out in subparagraph 6(1)(a)(i) of the ITA.

If a management employee receives a lump-sum amount under the insurance, we believe that such amount is not taxable under the terms of paragraph 6(1)(f) of the ITA since, among other reasons, this type of insurance does not provide an income to the beneficiary on a periodic basis.

Long-Term Care Insurance Policy

Employer-paid premiums for this type of coverage would also be deductible from the employer's income for the same reasons as those applicable to critical illness insurance.

Based on our understanding of this type of insurance, two benefit payment mechanisms are generally used. Under the first, beneficiaries are reimbursed for the expenses they incur, while under the second, fixed payments are made on a periodic basis regardless of the amount of expenses actually incurred by the insurance beneficiary. As mentioned above in the case of critical illness insurance, if an employer pays insurance premiums on behalf of its employees, a taxable benefit may arise for employees pursuant to paragraph 6(1)(a) of the ITA, unless one of the exceptions set out in that paragraph applies. For long-term care insurance, two of the exceptions set out in subparagraph 6(1)(a)(i)of the ITA might apply. If a beneficiary is reimbursed for his expenses under the insurance plan, then that plan might, in certain cases, be considered a private health insurance plan. If the insurance plan provides for fixed payments on a periodic basis, the plan might be considered sickness or accident insurance and be part of a group sickness or accident insurance plan for the same reasons as those mentioned above for critical illness insurance. If the insurance qualifies for one of the exceptions set out in subparagraph 6(1)(a)(i) of the ITA, then there would be no taxable benefit for employees.

Amounts received by an employee on a periodic basis under such long-term care insurance plans are not taxable pursuant to paragraph 6(1)(f) of the ITA if they are received in accordance with the terms of the insurance policy as compensation for services received at home or in an institution and not because of the loss of income from an office or employment.